Financial programs. Lifehacks and specifics

The most efficient instruments and traffic tools, tips, and a traffic acquisition funnel model.

In this text we will discuss how publishers can earn more on these programs.

For starters, let’s recall what makes financial programs more beneficial than other niches: the highest rates, numerous subcategories, and various traffic monetization and re-monetization tools. Don’t forget about pitfalls, though, such as strict traffic quality requirements, high competition, and demanding users. Let’s delve into the tough points and how to deal with them.

Instruments for managing financial programs

We’ll tell you about the tools that will help you monetize and re-monetize your traffic. The key ones are financial affiliate stores, newsletters (text messages, email, and push notifications), and API.

What is re-monetization? It’s a process when you earn additional profit. Say a user comes to your landing page and fills out a loan application but doesn’t receive the loan in the end. You can—and should—re-monetize this user.

Publishers mainly use the following models:

- They purchase traffic and drive it to their financial affiliate store, from which a user visits an advertiser’s website and fills out a form.

- They collect forms on their own to then monetize them via text messages, emails, and push notifications.

- They use APIs, a technology that allows a publisher to integrate directly with an advertiser and transfer an application to them via the API. Affiliate networks usually have a pool of advertisers that use this tool.

In this context, it’s important to realize that when you send an application via an API, you trigger a barrage of calls to the user from banks and financial companies. After seeing that kind of spam, the user will no longer answer calls from financial institutions. That’s why you should analyze which programs deliver more earnings and then transfer the client’s application to the top-performing bank first. Only sometime later can you start transferring applications to other banks.

Using the API, the publisher sends applications they collect on their site to the advertisers’ site at certain intervals. This is how one can purchase traffic from advertising sources, optimize it for conversions, and receive target traffic at the best prices. Learn more about APIs here and here.

The best traffic types for financial programs

Be sure to differentiate between traffic sources so you can determine which one generates converts the best. You can use SubID for that or automatically pass traffic parameters via API.

Here’s how traffic sources are distributed in the financial niche according to data from Admitad:

- 50% goes to media buying

- 29% to financial affiliate stores

- 8% to websites

- 4% to email

- 2% to affiliate stores

- 2% to coupon and promo code services

- 5% to other

Half of traffic volume comes from media buying. This category includes the direct purchase of traffic from Facebook, Google, and pop-under ad networks. Financial affiliate stores are mainly theme SEO showcases. Websites are mostly major spaces that publish various offers, including financial ads (e.g., as banners).

A few words about forbidden traffic types:

- Incentive traffic. We call it incentive traffic when a publisher invites a user to follow a link and get rewarded for that. Unfortunately, such motivated users are rarely target traffic, and such conversions are usually declined.

- Advertiser mimicking. A publisher creates ad spaces that look like an advertiser’s ad spaces with a similar domain or design.

- Spam.

- Gutter teasers.

- Other traffic sources forbidden by a certain program. One can find them in the affiliate program catalog:

Pro tips for publishers

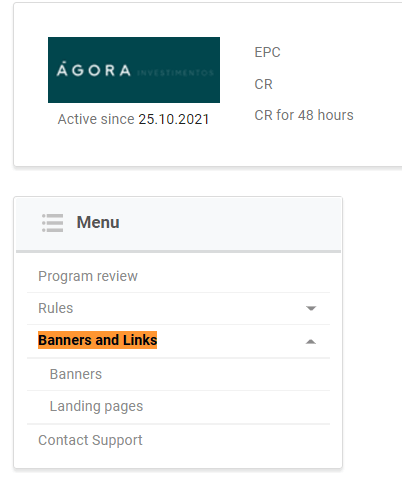

- It’s imperative that you work out your ad campaign’s visuals. Use an advertiser’s banners or gain approval for your unique creatives. You can communicate with an advertiser directly or through your personal manager (find the “Contact us” button in the affiliate program catalog). Avoid using banners or landing pages that haven’t been approved by the advertiser you cooperate with. Otherwise, you may be banned from the program.

Advertisers often produce creatives dedicated to major events or promotions. Find them in the special section:

- Publish unique creatives. If you decide to use some ready-made solutions (e.g., from Publer or similar resources), be sure to adapt them to your ad space. We recommend removing metadata, mirroring a photo or video, applying some effects, and playing with color filters.

- Always check the hold period in the program you plan to cooperate with. This insight will help you manage your income flow so you know when you receive your rewards and can reinvest them in further advertising. And so you know, Admitad has a tool called Instant Payout that allows a publisher to withdraw their funds whenever they need.

- If you run ad campaigns on Facebook or Google, it’s important that you optimize them for higher conversions. By doing so, you can purchase traffic at optimal prices and see which creatives or keywords result in more conversions.

- The most powerful conversion-generating channels are niche financial ad spaces and segmented databases.

- Take into account the day of the week and the time you send newsletters. In email marketing, conversions are better on weekdays.

- What you should definitely avoid doing is spamming old and non-target user bases with newsletters (by email or text message). User bases that you’ve you purchased rather than built on your own don’t convert. Both advertisers and publishers need up-to-date target user bases since only these resources can drive relevant traffic, generate higher conversions, and eventually secure better confirmation rates and larger income.

- Leads may strongly vary in cost from region to region. Exclude the locations that perform the worst and always check where your programs operate. For instance, a bank may block leads from certain regions if there are no offices there.

- Mobile traffic holds a great share in the financial segment. Optimize your website for portable devices and build a proper semantic kernel for mobile search.

- To pass program moderation successfully, be sure to specify additional details when submitting an application (e.g., traffic source, methods, etc.). If moderation takes longer than necessary, contact your manager or create a ticket.

Grab a bunch of extra tips on mining financial traffic on social media.

- One of the most popular channels today is TikTok. In the financial segment, most conversions are generated in bank apps (e.g., when a publisher is rewarded for a user installing such an app) rather than from purchasing financial traffic and driving it to a website.

Another noteworthy option is that some publishers develop their own mobile apps with a financial affiliate store and a pre-landing page to collect data. It may be efficient to purchase TikTok traffic for such apps. - Users report that Facebook may ban links to financial affiliate stores. If that happens to you, try to create a pre-landing page and drive traffic to it first before redirecting it to the affiliate store website.

- Since Instagram users are more prone to impulse buying, cashback cards and fast loan offers demonstrate amazing performance on that network.

- As for messengers, sales funnels there are often built on a chat bot. A publisher creates a chat bot and purchases traffic from Facebook for the bot or drives traffic to it from email newsletters. A user is offered loan programs tailored to their needs, and links lead them to a showcase or website.

Credit cards with benefits like cashback, as well as theme cards, are great tools in this market. If a channel is devoted to travel, the best option is a card offering extra bonuses for globetrotters.

A basic traffic generation funnel in the financial niche

As a rule, publishers purchase traffic from paid sources (e.g., Facebook, Google, etc.) and then lead users to a lead collection form. This kind of form can be a pre-landing to a website that collects user data. (Don’t forget to add a personal data processing consent message!).

After filling out the application form, the user is taken to the financial affiliate store, where they can find offers and head to the advertiser’s website. Once there, they perform a target action (e.g., apply for a loan).

In addition to that, once a form is filled out, you can transfer it to various banks via an API. For instance, if a user sees 10 offers at the affiliate store, they may ignore some, but you can transfer them to an advertiser via a free API channel. The advertiser will then call that user or send them a text message. This is how you can re-monetize traffic that doesn’t convert at the affiliate store.

In the final stage, the publisher compiles the application base and can send email or text message newsletters (the latter is a costlier channel). Another option is to collect push notification subscriptions, which can also be a powerful re-monetization technique.

We wish you happy earnings on your financial programs!